Unified commerce represents a radical change in the way technology is shaping retail commerce, which is one of the most dynamic and forward-looking sectors. It has to be, because customers, as users of technology, continue to drive the revolution of retail with constantly changing expectations in terms of experience, service and promotional offers.

With unified commerce merging potentially disparate systems (front and back) into a single platform, technology is no longer an entity on its own: it is becoming integrated in the businesses of retailers, offering an agile system to provide efficient service in all channels.

1. A shopping centre where people can work, live and play

The shopping centre is being reborn as a town centre with local shops, all the more so due to the current health crisis.

Digital continues to reshuffle the cards, as new shopping centres will focus on interaction, convenience and experiences in terms of shopping. Concepts such as co working and entertainment spaces put “experience” and the “work-live-play” trio at the heart of their strategies. They will replace the outmoded shopping centres of the twentieth-century.

Shopping centres that really manage to harness digital and put it at the centre of their strategy will become favoured destinations, in particular thanks to restaurants, theme bars and high-end coffee shops managed by big-name chefs, as well as the presence of offices, gyms and even schools. In short, shopping centres will become the new town centres.

2. Behaviour in shops will be directly linked to people’s profiles

Using facial recognition and GPS tracking alone is not enough to make a retailer omni channel.

Physical retailers can bridge the gap between the collection of data online and people’s behaviour through the use of cameras, facial recognition, tracking, checkout (POS) data and analysis, such as Google Analytics. Just as e-commerce players can analyse the behaviour of customers on their websites, physical stores will use WiFi, sensors, RFID tags and various other means. The aim is of course to identify areas of high footfall within the store, abandoned (non-purchased) products, waiting times and even the movement of products between the shelves and fitting rooms.

From real-time merchandising to decision-making based on data related to the management of physical interactions and stock, the age of real-world data is here. Combined with web, mobile and social network data, the collection and analysis of in-person data brings brands closer to a truly 360-degree customer experience.

Amazon Go stores use “computer vision” to recognise faces and products, in order to offer a smooth purchasing experience, without having to go through a checkout. Along with browsing and mobile telephony data, stores are equipping themselves to make better, more personalised recommendations on all platforms. Retail Deep replaces loyalty cards with facial recognition, using in-store cameras equipped with AI, which send notifications and relevant recommendations to staff when known customers arrive. There is no more need for loyalty cards as customers are already identified by their faces. This Canadian startup has enjoyed success on the Chinese market where facial recognition is widely used.

Source: Retail Deep

3. Consumers are beginning to sell their data and privacy

With the growth of privacy protection (GDPR), consumers will choose which brands can access their information. For decades now, consumers have been exchanging data for access (social media) and rewards (loyalty schemes). Consumers know that their data (such as in-store movements, online browsing and geolocation) are used. They are now prepared to negotiate for them. Brands will move from attempting to gather as much data as possible from their users to a more lucrative exchange.

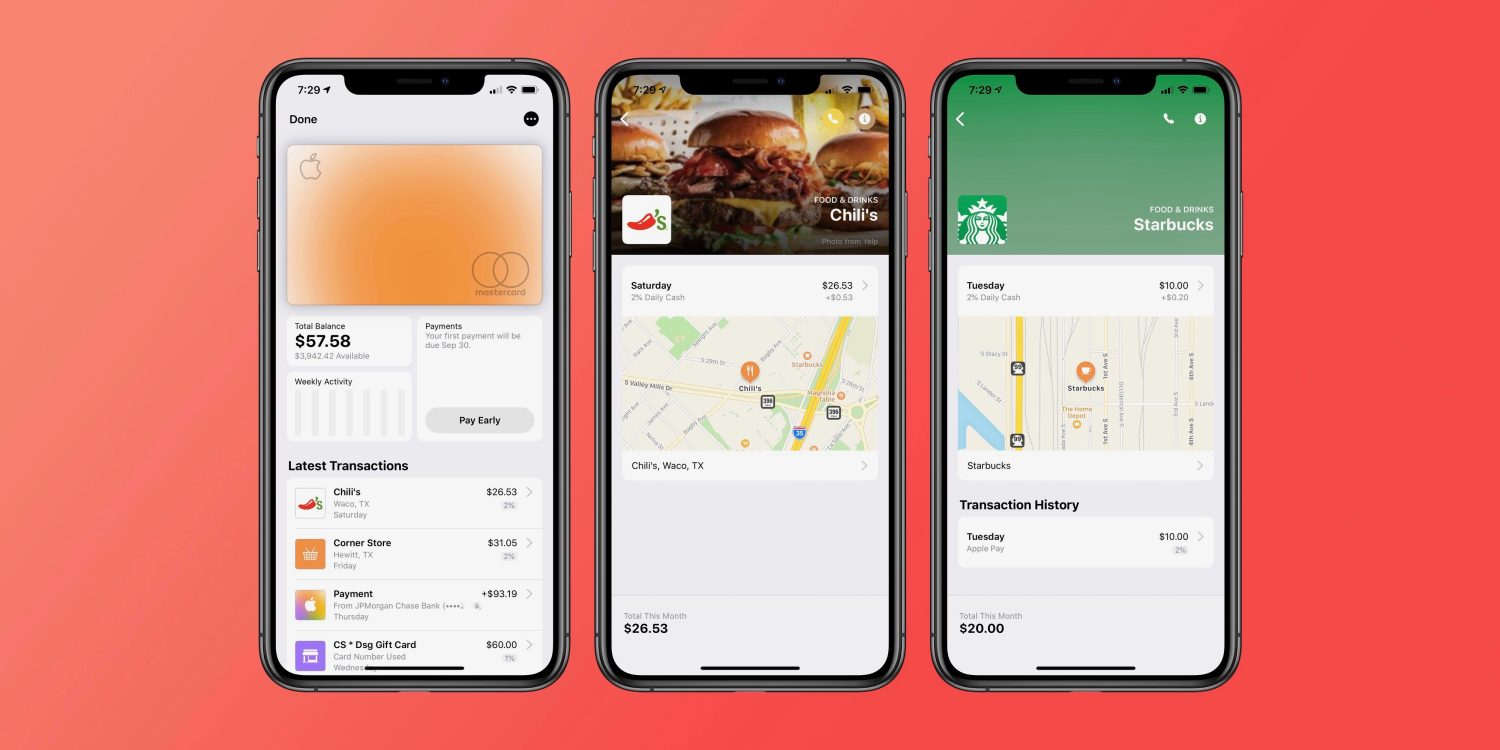

As the volume of personal data increases and awareness of privacy protection grows, a new type of services and options is likely to be developed: the respect of privacy as an option will mean that consumers will ask brands to “pay” them in order to use their data. The challenge for brands will be to strike a balance between the acquisition, use and storage of data, and then maintain this balance. Apple’s credit card promises privacy: purchasing data will not be used for advertising purposes, sold to third parties or for any other purpose. Accessible only to owners of an iPhone, the Apple Card is also linked to a reward scheme in the form of cashback.

Cashback with the Apple Card

4. The delivery war

Fast and free delivery will no longer be an option for ecommerce.

Amazon, which introduced free delivery, then free delivery in two days, next-day delivery and now same-day delivery (Prime Now), will enable competing retailers to offer the same service by becoming their carrier.

2020 is a tipping point for “free and fast delivery”, as Amazon’s logistics and delivery operations are aimed at disrupting the standard delivery and postal service sector. The ecommerce giant will move from the status of client to competitor for practically all major transport companies. After postal services, UPS and FedEx, consumers can expect to see Amazon’s logo on parcel delivery vehicles.

5. Delivery in your home, car or garage

“Near to your home” will become “In your home”. Retailers can now deliver into customers’ vehicles, homes and appliances. Take Walmart’s InHome Delivery service, for example. It uses “smart-entry technology” and cameras to deliver orders directly into customers’ fridges, kitchens and garages.

As the delivery war grows fiercer, transport companies and retailers are looking to make deliveries smoother and faster by delivering directly into peoples’ homes and cars using remote access technology.

In addition to speed, these delivery methods are aimed at making shopping easier and safer (by avoiding ice cream melting or thawing, for example) and reducing package theft, which in turn can reduce the costs and worries related to delivery/receipt of high-value items, such as consumer electronics and jewellery.

Content originally written by SQLI.